|

SalMar intends to launch a voluntary cash offer to acquire all outstanding shares in Norway Royal Salmon

(NORWAY, 8/25/2021)

(NORWAY, 8/25/2021)

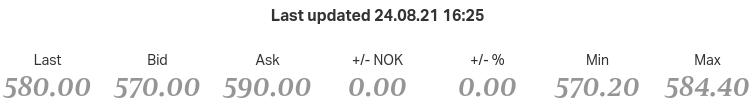

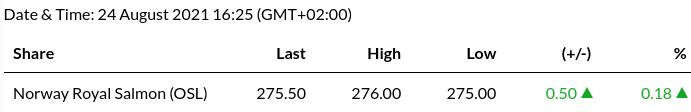

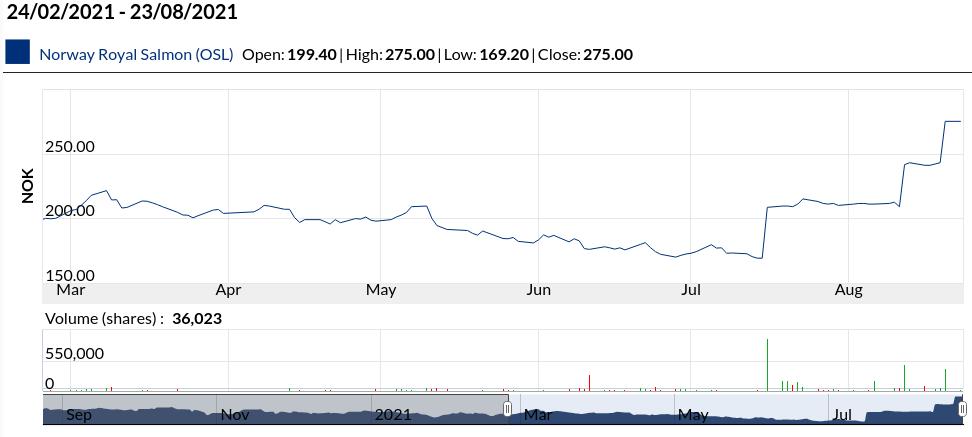

- Voluntary cash offer to acquire all outstanding shares in Norway Royal Salmon for NOK 270 per share

- The Offer values the Company at approximately NOK 11,764 million and represents a 12.5% premium to the NTS offer and a premium of 54.0% to the 30 trading day VWAP of the NRS share prior to the date for the NTS offer

- With several overlapping industrial interests, both in Northern Norway, the West Fjords of Iceland, and offshore, a combination offers ample opportunities to realise significant synergies

SalMar ASA (“SalMar” or the “Offeror”) is pleased to announce that SalMar intends to launch a voluntary cash offer to acquire all outstanding shares in Norway Royal Salmon ASA (“Norway Royal Salmon”, “NRS”, or the “Company”) for NOK 270 per share (the “Offer Price”) (the “Offer”).

The Offer Price represents a 12.5% premium to the NTS offer of NOK 240 per share, and a premium of 54.0% and 42.0% to the 30 and 90 trading day VWAP of the Norway Royal Salmon share up to and including the date prior to the date for the NTS offer (15 July 2021), respectively. The Offer values the outstanding shares of the Company at approximately NOK 11,764 million.

Photo: courtesy Salmar

To facilitate and safeguard the success of the superior offer for the benefit of the NRS shareholders, SalMar has requested that the board of directors of NRS uses the authorisation granted to them at the annual general meeting of the Company held on 27 May 2021, to carry out a private placement of up to 4,357,219 new shares directed towards the superior bidder (the “Private Placement”) at a subscription price equal to the offer price of such superior bid. NRS has confirmed that the board of directors is prepared to use its authorisation accordingly.

Photo: courtesy Salmar

Rationale

Norway Royal Salmon and SalMar (the “Parties”) have several overlapping industrial interests, both in Northern Norway, the West Fjords of Iceland, and offshore. A combination of the Parties (the “Combination”) offers the opportunity to realise significant synergies:

- Both Parties have long-standing presence in, and considerable competence from, salmon farming in Northern Norway. A Combination will allow for improved utilisation of the combined available MAB and site portfolio as well as implementation of best practices within operations and the cost structure

- Norway Royal Salmon’s new smolt facility in Dåfjord outside Tromsø, together with SalMar’s existing smolt capacity and the Senja 2 and Tjuin facilities that are under construction, will be valuable resources that can guarantee delivery of the right smolt at the right time, which in turn will facilitate for improved biological results throughout the value chain

- SalMar’s new processing plant on Senja, InnovaNor, will secure large additional volumes through a Combination, allowing for economies of scale through improved utilisation and logistics, and reduction of biological risk

- Both parties have significant expertise in the sales and logistic channel, a combination will give improved access to customers worldwide.

- A possible combination of Icelandic Salmon (controlled by SalMar) and Arctic Fish (controlled by Norway Royal Salmon), both operating in the West Fjords of Iceland, will enable realisation of considerable synergies through e.g. improved operations at sea and an optimal structure in the value chain on land, including smolt, processing and sales

- Both SalMar and Norway Royal Salmon have made significant investments in offshore related farming technology, creating a large synergy potential. The Parties will together be a strong force in the further development and realisation of offshore farming

- A Combination will strengthen the competence and capacity, and position the Parties for further sustainable growth

Source: Salmar

Source: Royal Norway Salmon

Terms and conditions of the Offer

The Offeror will launch a voluntary cash offer to acquire all outstanding shares in Norway Royal Salmon for NOK 270 per share.

The Offeror will prepare an offer document (the “Offer Document”) setting out the terms and conditions of the Offer in accordance with Chapter 6 of the Norwegian Securities Trading Act, and the Offer will be launched following regulatory approval of the Offer Document by the Oslo Stock Exchange. The Offer Document will be distributed to Norway Royal Salmon shareholders as soon as practically possible following the required regulatory approval, expected to be obtained in the first half of September 2021.

Source: Royal Norway Salmon

The offer period will be four weeks (the “Offer Period”), subject to any extensions. Settlement of the Offer will be made within two weeks after announcement that Closing Condition (as defined below) (1) has been satisfied or waived, provided that the other Closing Conditions remain satisfied until such completion or are waived by the Offeror.

The completion of the Offer is expected to be subject to satisfaction or waiver by the Offeror, in whole or in part, and in its sole discretion, of the following conditions (the “Closing Conditions”):

- Minimum acceptance: The Offer shall on or prior to the expiration of the Offer Period have been validly accepted by shareholders of the Company representing, together with the Private Placement shares to be issued in the Private Placement and shares otherwise acquired by the Offeror, if applicable, more than 50% of the issued and outstanding shares and voting rights of the Company on a Fully Diluted (as defined below) basis, and such acceptances not being subject to any third party consents or rights in respect of pledges, right of first refusal or other third party rights of any nature whatsoever. For this purpose, “Fully Diluted” shall mean all issued shares in the Company together with all shares which the Company are to issue in the Private Placement, if applicable, and would be required to issue if all rights to subscribe for or otherwise require the Company to issue additional shares, under any agreement or instrument, existing at or prior to completion of the Offer, were exercised;

- No action by relevant authority: No relevant authority of a competent jurisdiction shall have taken any form of legal action (whether temporary, preliminary or permanent) that prohibits the consummation of the Offer or shall in connection with the Offer have imposed conditions upon the Offeror, the Company or any of their respective affiliates; and

- Ordinary conduct of business: That (i) the business of the Norway Royal Salmon group, in the period until settlement of the Offer, has in all material respects been conducted in the ordinary course and in accordance with applicable law, regulations and decisions of any relevant authority; (ii) except from the Private Placement, there has not been made, and not been passed any decision to make or published any intention to make, any corporate restructurings, changes in the share capital of the Company or any of its subsidiaries (except any issuance of shares to the Company or any company owned 100% by the Company), issuance of rights which entitles holders to demand new shares or similar securities in the Company or any of its subsidiaries, payment of dividends or other distributions to the Company’s shareholders, proposals to shareholders for merger or de-merger, or any other change of corporate structure except for any of the foregoing actions made as a part of an ordinary internal reorganisation, involving only wholly owned subsidiaries of the Company; (iii) the Company shall not have entered into any agreement for, or carried out any transaction that constitutes, a competing offer; (iv) neither the Company nor any of its affiliates shall have undertaken or committed to any acquisitions or disposals (including, without limitation, disposal of shares in a subsidiary or disposal of material assets, licenses or sites); and (v) neither the Company nor any of its affiliates shall have entered into any agreement outside the ordinary course of business

The Offer will not be subject to any financing or due diligence conditions.

Source: SalMar ASA

[email protected]

www.seafood.media

Information of the company:

|

Address:

|

Industriveien 51,

|

|

City:

|

Kverva

|

|

State/ZIP:

|

(NO-7266)

|

|

Country:

|

Norway

|

|

Phone:

|

+47 7244 7900

|

|

Fax:

|

+47 7244 7901

|

|

E-Mail:

|

[email protected]

|

More about:

|

Approval / Accreditation / Certified / Oversight by...

|

|