|

Photo: Stockfile/FIS

Globefish Report and Outlook for Canned Tuna

WORLDWIDE WORLDWIDE

Monday, July 22, 2024, 02:00 (GMT + 9)

The Americas

Processed tuna imports in the Americas were dominated by ready-to-eat products. North America: 2023 imports in the United States were 10 percent lower than the previous year, due to reduced demand for light-meat “tuna-inbrine” (skipjack and yellowfin); however, demand for the higher-value canned white-meat tuna (albacore) was stable. Among the leading supply sources, imports declined from Thailand, Ecuador, Mexico and Indonesia but remained stable from Viet Nam and Senegal. Processed tuna imports in the Americas were dominated by ready-to-eat products. North America: 2023 imports in the United States were 10 percent lower than the previous year, due to reduced demand for light-meat “tuna-inbrine” (skipjack and yellowfin); however, demand for the higher-value canned white-meat tuna (albacore) was stable. Among the leading supply sources, imports declined from Thailand, Ecuador, Mexico and Indonesia but remained stable from Viet Nam and Senegal.

In Canada, the import shortfall for canned tuna was 16.6 percent (31,157 tonnes) in 2023 against 2022.

In South America, imports declined in Colombia, Chile, Mexico, Argentina, Uruguay and Venezuela, impacting overall exports of canned tuna from the main supplier, Ecuador.

The European Union

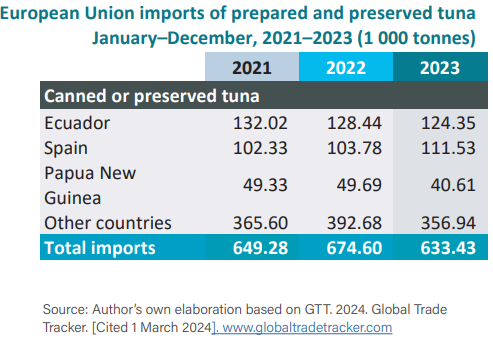

Consumer demand for semi-processed and ready-to-eat tuna declined in the EU market in 2023, which may explain why tuna canners imported significantly less cooked frozen tuna loins in Spain (-16 percent at 95,319 tonnes) and France (-44 percent at 5,596 tonnes), in contrast to Italy (+0.12 percent at 42,677 tonnes) and Portugal (+20 percent at 17,000 tonnes).

With regard to total imports under HS 160414 (processed and canned tuna), supplies (including extra-EU trade) declined by 5.7 percent at 643,465 tonnes in 2023, valued at USD 3.9 billion (+3.6%). The top importers were Spain, Italy, France, Germany and the Kingdom of the Netherlands.

The share of extra-EU supplies in the total imports of processed/canned tuna in 2023 was 76.5 percent or 429,732 tonnes, valued at USD 2.22 billion (including 166,415 tonnes of cooked frozen loins). The main exporters were Ecuador, Papua New Guinea, Mauritius, Seychelles, the Philippines and China.

Other European countries

The United Kingdom, the largest tuna market outside the European Union, reported an 8.6 percent decline in imports at 88,100 tonnes, comprising mostly “ready-to-eat” products. Supplies from Ecuador, Maldives, Thailand and the Philippines increased moderately, but declined from Papua New Guinea.

Imports intoSwitzerland, a small buthigh-end market in Europe, were 15 percent lower at 8 695 tonnes, year-on-year. A drop was also seen for Norway (-36.7 percent at 1,211 tonnes), in contrast to an increase by 33 percent in Ukraine.

MENA, Asia-Pacific and others

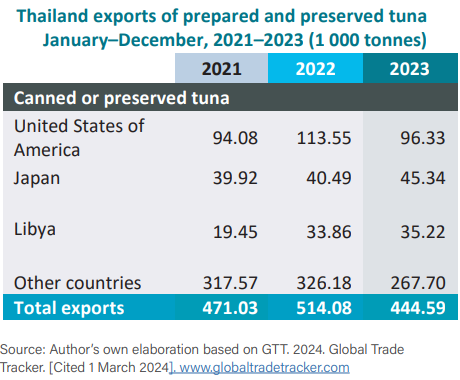

It is noteworthy to highlight that in 2023, Thai exports of canned and other types of ready-to-eat tuna to the Near East and North African (NENA) markets were 20 percent lower than 2022, at 151,900 tonnes. Supplies from Indonesia, the second largest exporter to this region, increased. It is noteworthy to highlight that in 2023, Thai exports of canned and other types of ready-to-eat tuna to the Near East and North African (NENA) markets were 20 percent lower than 2022, at 151,900 tonnes. Supplies from Indonesia, the second largest exporter to this region, increased.

Asia-Pacific imports of canned tuna increased marginally in Japan (+2 percent at 70,254 tonnes)), Malaysia (+3.7 percent at 4,641 tonnes) and the Republic of Korea (+126 percent at 4,498 tonnes), but declined in Australia (-20 percent), New Zealand (-8 percent) and also in Singapore. Specifically for Southeast Asia and the Far East, consumer preference for fresh fish over canned fish is supporting the demand for non-canned tuna, particularly sushi and sashimi, despite the price premium.

Prices

In April 2024, the delivery price of frozen skipjack from the Western Pacific Ocean to Thailand was 35 percent below last year’s level at USD 1,300 tonne. However, canners’ requisition for frozen raw material has not improved much as the Bangkok port remains congested with incoming cargoes.

In the Eastern Pacific Ocean, the skipjack price is stable at USD 1,450 per tonne, cfr Manta, Ecuador, supported by strong demand for finished goods in the export trade.

In Japan, frozen tuna landings at the Yaizu port weakened in April following a seven percent rise in landings during January-March 2024. Subsequently, the ex-vessel price of skipjack declined by eight percent to Yen 246 per kg.

For yellowfin, the price drop was higher (-17 percent) at Yen 342 per kg following a 45 percent increase in landings at the port.

As of mid-April 2024, prices of frozen skipjack are stable at EUR 1 650 per tonne, cfr Spain; while yellowfin prices increased sharply to the EUR 2,600 level due to high demand. The price for cooked, single-cleaned skipjack in Spain is steady at USD 5,350 per tonne.

Outlook

Consumer demand for canned tuna, ready-to-eat and tuna preparations remained weak during the first quarter of 2024, repeating last year’s tren Imports of processed tuna in January 2024 totalled 36,900 tonnes in Spain and 34 000 tonnes in the United States, lower than the corresponding quantities imported in January 2023. However, retail demand for end-products may improve in the western markets if the price adjustments derived from cheaper raw materials, benefit home consumers.

Source: Globefish

[email protected]

www.seafood.media

|

|