|

Photo: Stockfile /FIS

Global market landscape for Norwegian cod (fresh, frozen, salted, clipfish, stockfish...)

NORWAY

NORWAY

Thursday, January 09, 2025, 06:00 (GMT + 9)

.png)

Click on the image to enlarge

A challenging year for fresh cod

- Norway exported 40,370 tonnes of fresh cod worth NOK 2.6 billion in 2024

- The value fell by NOK 292 million, or 10 per cent, compared with the previous year.

- Volume fell by 18 per cent

- Denmark, the Netherlands and Spain were the largest markets for fresh cod last year

For fresh wild cod, the export volume fell by 29 per cent to 28,399 tonnes, while the export value fell by 23 per cent to NOK 1.8 billion. For fresh wild cod, the export volume fell by 29 per cent to 28,399 tonnes, while the export value fell by 23 per cent to NOK 1.8 billion.

For fresh farmed cod, the export volume increased by 37 per cent to 11,971 tonnes, while the export value increased by 55 per cent to NOK 722 million. Farmed cod accounted for 28 per cent of the export value of fresh cod in 2024

Lowest export volume since 2011

“A decline in quotas and landings of fresh cod, together with a Norwegian land-based industry that will continue to use its raw material to produce salted fish, clipfish and stockfish, are the reasons for the sharp drop in volume for fresh wild cod in 2024. We have to go all the way back to 2011 to find a lower export volume of fresh wild cod," says seafood analyst Eivind Hestvik Brækkan of the Norwegian Seafood Council.

.png)

Click on the image to enlarge

Moderate economic development in our key fresh markets in Europe contributed to the fall in volume resulting in relatively weak price growth for fresh wild cod.

Continued growth for farmed cod

.jpg) Farmed cod continues to increase in volume and in the fourth quarter accounted for more than half of exports of fresh cod. Most of the volume goes to the transit and processing market, the Netherlands, before being re-exported to other markets. Farmed cod continues to increase in volume and in the fourth quarter accounted for more than half of exports of fresh cod. Most of the volume goes to the transit and processing market, the Netherlands, before being re-exported to other markets.

"Despite reduced quotas, the quality brand of skrei enjoyed solid growth in both volume and value to Spain last year. Spaniards greatly appreciate seasonal seafood products, and skrei is a big star among supermarkets and Spanish consumers," says Tore Holvik, the Norwegian Seafood Council's envoy to Spain.

Good interest from Spanish supermarkets

Spain is also one of Norway's most important markets for farmed cod, with stable direct exports measured in volume last year.

"We're experiencing good interest from the supermarkets. Farmed cod helps to ensure a steady supply of fresh cod throughout the year, so that Spaniards can also enjoy Norwegian cod outside the cod season," says Holvik. "We're experiencing good interest from the supermarkets. Farmed cod helps to ensure a steady supply of fresh cod throughout the year, so that Spaniards can also enjoy Norwegian cod outside the cod season," says Holvik.

Exports of fresh cod in December

- Norway exported 2,000 tonnes of fresh cod worth NOK 137 million in December

- The value increased by NOK 26 million, or 23 per cent, compared with December last year

- This is a growth in volume of 8 per cent

- Norway exported 48,166 tonnes of frozen cod worth NOK 3.1 billion in 2024

- The value fell by NOK 390 million, or 11 per cent, compared with the previous year

- Volume fell by 22 per cent

- The UK, China and Vietnam were the largest markets for frozen cod last year

.png) Naturally, lower cod quotas have contributed to a significant decline in volume for frozen cod. Naturally, lower cod quotas have contributed to a significant decline in volume for frozen cod.

China saw the greatest growth in value last year, with an increase in export value of NOK 228 million, or 36 per cent, compared with the previous year. The export volume to China ended at 14,715 tonnes, which is 2 per cent higher than the previous year.

UK was largest market

"China's strong development must be seen in light of the US import ban on Russian cod. The Chinese processing industry has thus bought more cod from Norway to be able to continue offering cod to its American customers," says seafood analyst Eivind Hestvik Brækkan of the Norwegian Seafood Council.

The UK remained the largest market for frozen cod in 2024, although there was a decline in both export volume and export value to the UK. As much as 29 per cent of frozen cod went to the UK in 2024, measured in value.

.png)

Click on the image to enlarge

Taking a higher share

"The relatively good development in the UK illustrates how strong our traditional cod markets are. When volumes fall, these markets take a higher share of Norwegian cod," says Brækkan.

.png) The UK continues to be an extremely important market for Norwegian seafood, especially cod and haddock. The UK continues to be an extremely important market for Norwegian seafood, especially cod and haddock.

“It has been 15 years since such a large proportion of Norwegian frozen cod was exported to this market. Cod and haddock are among the most popular seafood products with UK consumers, particularly through the iconic fish & chips sector. Overall, 2024 shows the strength of the seafood trade between our two countries," says Victoria Braathen, the Norwegian Seafood Council's envoy to the UK.

Exports of frozen cod in December

- Norway exported 2,700 tonnes of frozen cod worth NOK 218 million in December

- The value fell by NOK 73 million, or 25 per cent, compared with December last year

- Volume fell by 52 per cent

- Norway exported 81,268 tonnes of clipfish worth NOK 5.9 billion in 2024

- The value fell by NOK 160 million, or 3 per cent, compared with the previous year.

- Volume fell by 4 per cent

- Portugal, Brazil and the Dominican Republic were the largest markets for clipfish last year

(1).png)

For saithe clipfish, the export volume fell by 3 per cent to 47,780 tonnes, while the export value fell by 9 per cent to NOK 2.1 billion.

For cod clipfish, the export volume fell by 4 per cent to 25,536 tonnes, while the export value increased by 3 per cent to NOK 3.3 billion.

Portugal saw the greatest growth in value last year, with an increase in export value of NOK 158 million, or 7 per cent, compared with the previous year. The export volume to Portugal ended at 19,506 tonnes, which is 1 per cent lower than the previous year.

Largest share ever for Portugal

“While Portugal completely dominates as our largest market for cod clipfish, it has also been our largest market for all Norwegian cod combined for over 30 years. In 2024, as much as 35 per cent of Norwegian cod exports in terms of value went to Portugal. This is the highest share ever," says seafood analyst Eivind Hestvik Brækkan of the Norwegian Seafood Council. “While Portugal completely dominates as our largest market for cod clipfish, it has also been our largest market for all Norwegian cod combined for over 30 years. In 2024, as much as 35 per cent of Norwegian cod exports in terms of value went to Portugal. This is the highest share ever," says seafood analyst Eivind Hestvik Brækkan of the Norwegian Seafood Council.

“This development illustrates that the Portuguese will have their bacalao regardless and that our traditional cod markets are strong even when cod quotas fall," says Trond Rismo, the Norwegian Seafood Council's envoy to Portugal.

Exports of clipfish in December

- Norway exported 5,700 tonnes of clipfish worth NOK 466 million in December

- The value fell by NOK 56 million, or 11 per cent, compared to December last year

- Volume fell by 23 per cent

- Norway exported 24,243 tonnes of salted fish worth NOK 2.2 billion in 2024

- The value fell by NOK 32 million, or 1 per cent, compared with the previous year.

- Volume fell by 12 per cent

- Portugal, Italy and Greece were the largest markets for salted fish last year

High price growth helped to keep the export value stable in a year characterised by lower quotas and less access to raw materials for salted fish production in Norway.

As usual, Portugal dominates as the largest destination market. As much as 76 per cent of salted fish exports in terms of value went to Portugal last year. This is the highest proportion ever.

Shift towards prepared products

“The salted fish is used by the Portuguese industry to produce clipfish, prepared products and pre-diluted bacalao, both for domestic consumption and export. "In Portugal, too, we are seeing a steady shift in demand towards more prepared products, which is helping to boost demand for salted fish in this market," says seafood analyst Eivind Hestvik Brækkan of the Norwegian Seafood Council. “The salted fish is used by the Portuguese industry to produce clipfish, prepared products and pre-diluted bacalao, both for domestic consumption and export. "In Portugal, too, we are seeing a steady shift in demand towards more prepared products, which is helping to boost demand for salted fish in this market," says seafood analyst Eivind Hestvik Brækkan of the Norwegian Seafood Council.

Exports of salted fish in December

- Norway exported 595 tonnes of salted fish worth NOK 41 million in December

- The value fell by NOK 6 million, or 12 per cent, compared to December last year

- Volume fell by 21 per cent

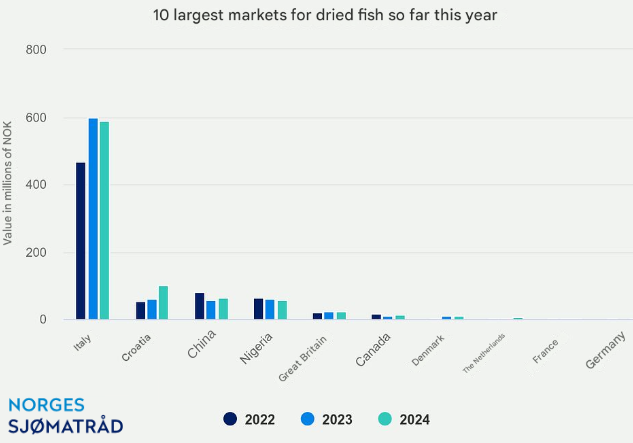

- Norway exported 3,531 tonnes of stockfish worth NOK 897 million in 2024

- The value increased by NOK 11 million, or 1 per cent, compared with the previous year

- Volume fell by 4 per cent

- Italy, Croatia and the US were the largest markets for stockfish last year

Cod stockfish, which accounts for more than 90 per cent of stockfish exports, had an export value of NOK 818 million.

This is 5 per cent higher than last year and the highest export value ever. The export volume was 2,700 tonnes, unchanged from 2023. The export volume in the last two years is the lowest ever recorded.

Largest increase to Croatia

Croatia had the highest value growth last year, with an increase in export value of NOK 42 million, or 68 per cent, compared with the previous year. The export volume to Croatia ended at 317 tonnes, which is 57 per cent higher than the previous year.

Our largest stockfish market, Italy, saw a decline in export volume of 5 per cent, to a total of 1,800 tonnes.

"This is the lowest export volume of stockfish to Italy ever recorded. The export value fell 2 per cent to a total of NOK 589 million," says seafood analyst Eivind Hestvik Brækkan of the Norwegian Seafood Council.

Tougher battle for raw materials

Lower cod quotas and higher raw material prices have contributed to a tougher battle for raw materials for the Norwegian stockfish industry.

"Higher production costs are forcing a higher stockfish price, which may take time for the market to adjust. Relatively weak economic development in Italy may also have helped to dampen demand for stockfish, which is an expensive and exclusive product," says Brækkan.

Exports of stockfish in December

- Norway exported 183 tonnes of stockfish worth NOK 45 million in December

- The value increased by NOK 4 million, or 11 per cent, compared to December last year

- This is a growth in volume of 13 per cent

[email protected]

www.seafood.media

|

|