|

Photo: FAO-Globefish

FAO-Globefish - Tuna Market Overview

WORLDWIDE WORLDWIDE

Monday, March 10, 2025, 09:00 (GMT + 9)

Higher tuna trade in 2024

International tuna trade recovered during January–September 2024 with a 20 percent rise in imports at three million tonnes valued at USD 11.86 billion, as compared to the same period in 2023. Fluctuating tuna catches and improved demand for ready-to-eat tuna kept the global tuna trade reasonably active during the second half of 2024. Imports of raw frozen tuna and cooked frozen loins increased at packers’ level in Asia and Europe. In the higher-value non-canned tuna trade, consumer demand moved towards frozen fillets.

.png)

Global supplies

Tuna catches worldwide were anything but stable during the second half of 2024. Skipjack catches did not improve much in the Western and Central Pacific after the opening of the FAD fishing season in October. Global supplies

.jpeg) In the Eastern Pacific Ocean, the second 72-day IATTC “veda” (ban) was in force until 19 January 2025. Only 23 percent of the fishing fleet was operating during the closed period due to a combination of the veda and the year-end holidays. Moderate catches are reported for vessels engaged in fishing. Raw material prices are stable at Manta, Ecuador, as carriers from the Western and Central Pacific send supplies to supplement local landings. In the Eastern Pacific Ocean, the second 72-day IATTC “veda” (ban) was in force until 19 January 2025. Only 23 percent of the fishing fleet was operating during the closed period due to a combination of the veda and the year-end holidays. Moderate catches are reported for vessels engaged in fishing. Raw material prices are stable at Manta, Ecuador, as carriers from the Western and Central Pacific send supplies to supplement local landings.

Most vessels in the Indian Ocean have resumed fishing and catches are moderate. The demand for raw material is yet to improve, keeping the skipjack prices soft while yellowfin prices are steady. There was very little product movement in the European market during the year-end holidays. By early January, the 2025 duty-free quota for imports of tuna loins from third countries was exhausted very quickly.

As of January 2025, the overall catch level has been moderate in the Atlantic Ocean but with a high percentage of small-sized skipjack and non-tuna species, not suitable for canning. Consequently, raw material for tuna canners is in short supply and prices are on the rise for both skipjack and yellowfin.

Trade and markets

Supported by increased demand from end-consumers, global imports of raw materials increased in order to produce semi-processed cooked loins and ready-to-eat products.

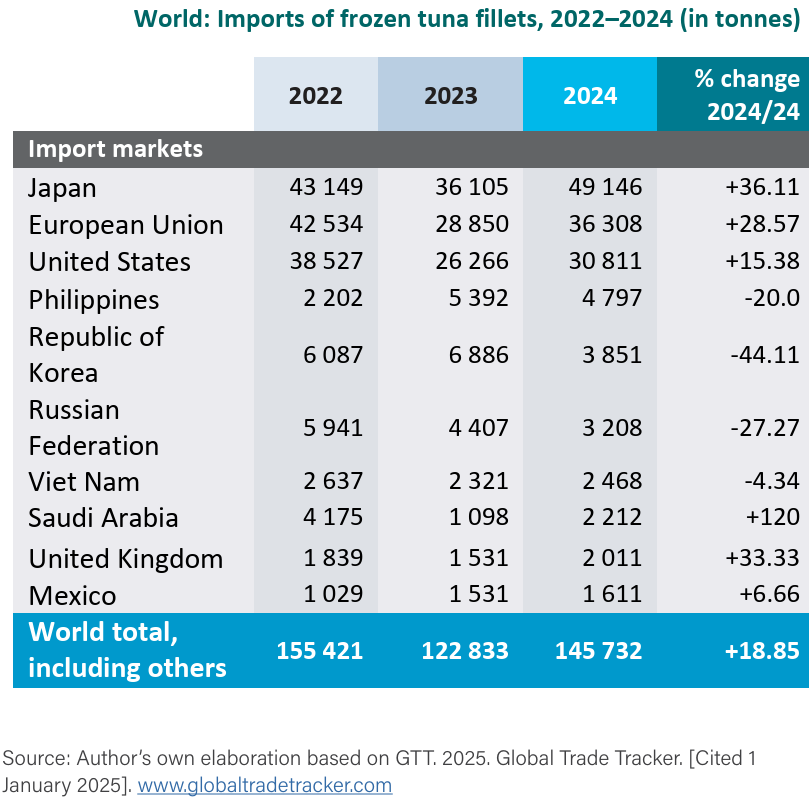

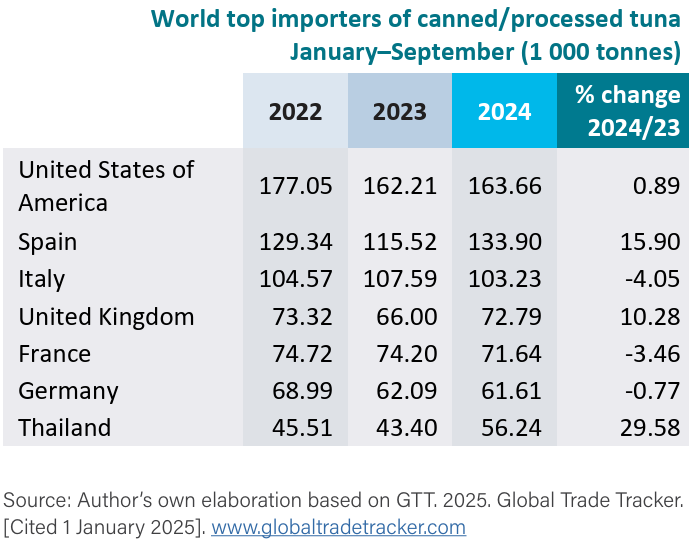

During January–September 2024, the world trade of tuna (fresh, frozen and canned) was estimated at 3.07 million tonnes valued at USD 11.86 billion, representing rises of 20 percent and 1.28 percent respectively as compared to the same period in 2023. Imports of fresh tuna were 80 765 tonnes worth USD 656.96 million (USD 772.59 million in January–September 2023); raw frozen tuna imports increased by 32 percent at 1.68 million tonnes valued at USD 4.72 billion; while imports of processed and canned tuna that held a 38 percent share in the total tuna trade, amounted to 1.17 million tonnes (+8.58 percent) valued at USD 6.5 billion.

In the higher-value non-canned tuna trade, imports of fresh tuna continued to weaken. On the other hand, deep-frozen tuna loins, fillets and similar semi-processed/prepared products (uncooked) saw increased demand and imports in the large and conventional markets led by Japan, the European Union and the United States of America.

Raw materials for canning and other uses

Trading of whole frozen tuna increased worldwide in the second half of 2024 as packers in Europe and Southeast Asia looked for more raw material for processing into cooked loins and ready-to-eat products.

During January–September 2024, the estimated world imports of whole frozen tuna were 1.68 million tonnes, which is 30.47 percent higher than the corresponding period in 2023. Thailand had a 40.50 share in this total with a 34 percent rise in supply, year-on-year. Packers in China, the Philippines and Viet Nam also imported more raw frozen tuna to produce semi-processed cooked frozen loins for exports.

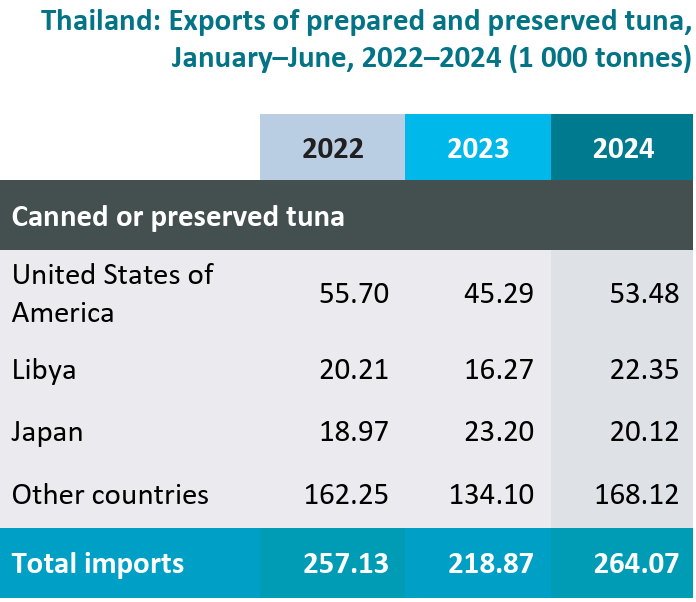

Affected by rising labour costs, tuna canners in Thailand are moving away from raw fish to cooked frozen loins. Accordingly, these imports increased by 30 percent year-on-year at 58 240 tonnes during January–September 2024. China, Indonesia and Viet Nam were the top suppliers.

Meanwhile, tuna canners in Europe, the largest user group of cooked loins, imported 148 495 tonnes of this product during the period under review, 7.24 percent higher than the corresponding months in 2023. Spain was the top importer, followed by France, Italy and Portugal.

Fresh and frozen tuna (non-canned)

In general, global demand for higher-value non-canned tuna remained steady in 2024, but with reduced sales of fresh tuna and increased requisitions of deep-frozen tuna loins/fillets, steaks, saku bars, cubes and similar product groups.

Fresh tuna imports moderated in Europe, North America and also in Asia (China, Japan and Thailand) during January–September 2024 but increased for deep-frozen tuna loins/fillets and similar semi-processed products (uncooked) in Japan, the European Union and the United States.

Japan

According to the INFOFISH Trade News, the Toyosu Fish Market celebrated the first tuna auction of 2025 with a 275 kg locally caught bluefin, sold at JPY207 million (USD1.3 million). This was the second highest bid over the past decade.

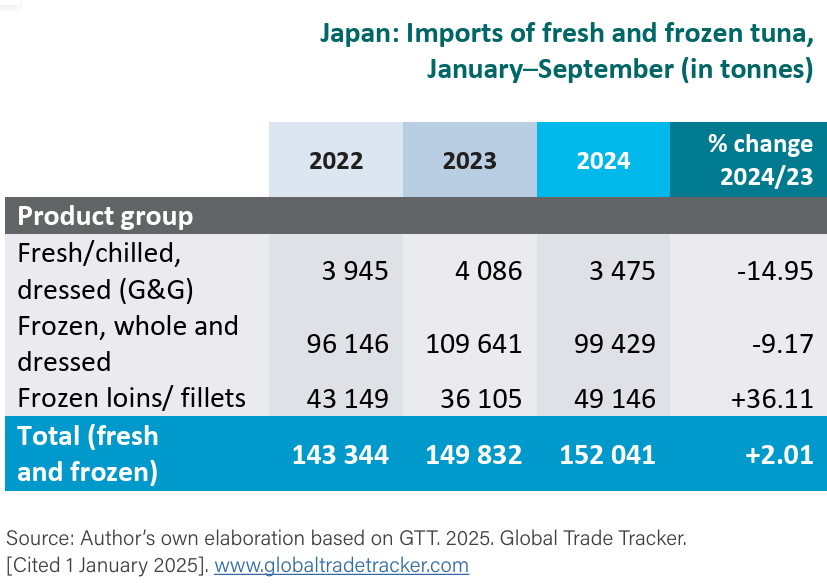

Gregorian New Year celebrations continued till the first week of January 2025 in Japan, with good sales in the restaurant business. Thereafter, trading slowed down; this trend will persist until the high consumption season in March–May, marking the Spring festival and the Golden Week celebrations. Despite a decline in the imports of fresh and frozen sashimi-grade tuna during January–September 2024 against the same period in 2023, Japan’s hotel, restaurant and catering (HORECA) trade is reported to be well-prepared for the upcoming consumption season due to large imports of deep-frozen tuna fillets (+36.11 percent, year-on-year). Gregorian New Year celebrations continued till the first week of January 2025 in Japan, with good sales in the restaurant business. Thereafter, trading slowed down; this trend will persist until the high consumption season in March–May, marking the Spring festival and the Golden Week celebrations. Despite a decline in the imports of fresh and frozen sashimi-grade tuna during January–September 2024 against the same period in 2023, Japan’s hotel, restaurant and catering (HORECA) trade is reported to be well-prepared for the upcoming consumption season due to large imports of deep-frozen tuna fillets (+36.11 percent, year-on-year).

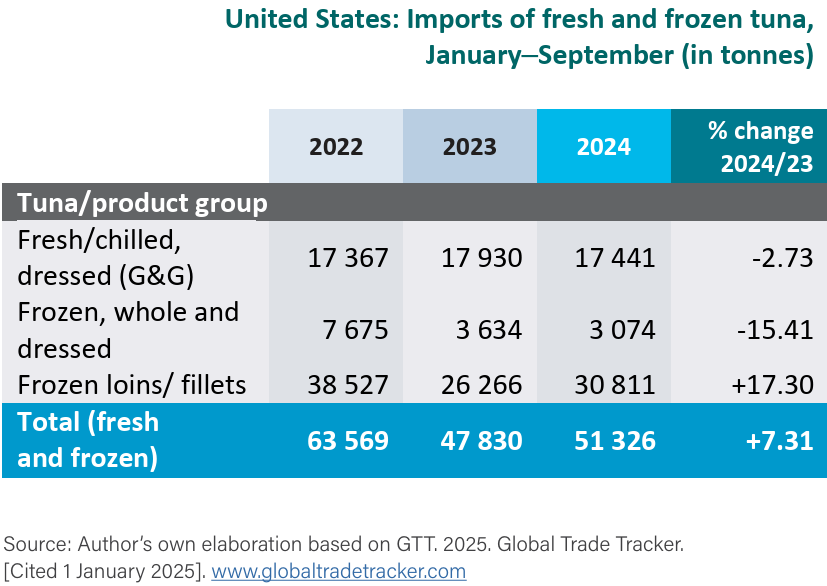

The United States of America

In the first nine months of 2024, consumer demand for canned and other types of prepared tuna in the US market seemed to have reached saturation levels, whereas it is still growing for the non-canned tuna group (both sashimi and non-sashimi). The second quarter of 2024 saw some recovery in the frozen fillets market; however, demand for fresh tuna has been limited to the restaurant trade. Imports of the higher-value fresh and frozen non-canned tuna category during January–September 2024 amounted to 51 326 tonnes valued at USD 639 million, 7.3 percent higher year-on-year. The frozen tuna fillets product group was responsible for this positive development, imports of which increased by 17.3 percent (30 811 tonnes; USD 348.70 million) yearon-year. The leading suppliers were Indonesia, the Philippines, Thailand, Taiwan Province of China and Viet Nam.

Europe

Demand in the European Union for fresh/chilled tuna and frozen tuna loins/ fillets was good in the restaurant and catering trade during the summer holiday months. Imports of these products totalled 62 117 tonnes during January–September 2024 with France, Italy, Malta, Portugal and Spain being the leading importers of fresh tuna. Imports of frozen tuna (whole and dressed) amounted to 129 572 tonnes; these were generally meant for reprocessing into canned and similar product groups (HS 160414).

In other European markets, frozen tuna fillets comprised the most popular product group. Their imports declined in the Russian Federation at 3 208 tonnes (-27 percent) but increased in Norway, Switzerland, the United Kingdom of Great Britain and Northern Ireland and Ukraine.

China

In 2020, fresh tuna imports (mostly bluefin tuna) from Japan into the Chinese market were 474 tonnes, rising to 1 137 tonnes in 2022. However, these imports stopped in August 2023 due to China’s ban on Japanese seafood linked to the release of treated water from the Fukushima Daiichi nuclear power plant into the Pacific Ocean. This led to increased supplies from Australia, Indonesia and Spain to the Chinese market; in 2024, imports of high-value fresh and frozen tuna reached 2 616 tonnes. Japanese restaurants in China (estimated to number 78 760 in 2023), are the main users of sashimi tuna in the country.

During the Chinese New Year festival in January–February 2025, demand for sashimi tuna increased significantly throughout China, although competition with salmon remained strong in the sushi and sashimi trade.

Canned/processed tuna

World World

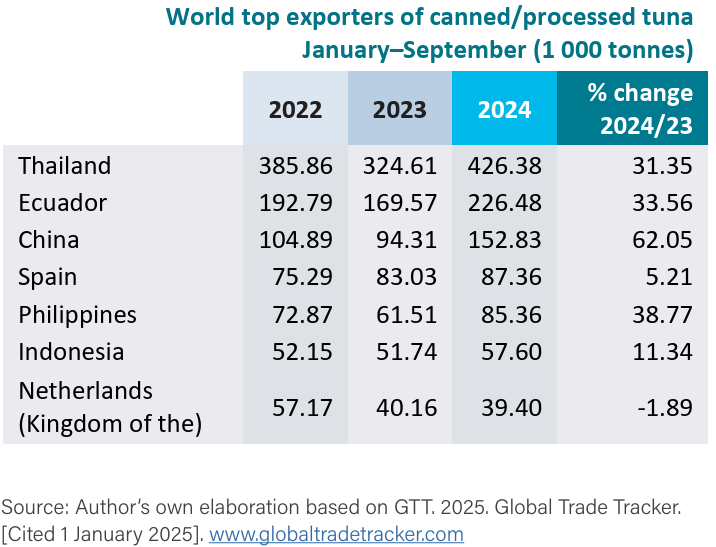

The international market for processed and canned tuna (HS 160414) started to recover from the second half of 2024. Total imports during JanuarySeptember 2024 were 1.17 million tonnes valued at USD 6.50 billion, up by 8.58 percent in quantity and 4.84 percent in value, year-on-year. Strong demand for semi-processed raw materials (cooked frozen loins) in Europe and Southeast Asia contributed significantly to this development.

Thailand

Thailand, the world’s largest producer/exporter of ready-to-eat tuna, saw substantial gains in its January–September 2024 exports (+31.35 percent year-on-year), supplying more than 40 markets in North America, Europe, the Near East and the Asia-Pacific region. China, Ecuador, Indonesia and the Philippines also reported improved performances, which could be attributed to increased exports of cooked frozen loins to regional tuna canning industries. Thailand, the world’s largest producer/exporter of ready-to-eat tuna, saw substantial gains in its January–September 2024 exports (+31.35 percent year-on-year), supplying more than 40 markets in North America, Europe, the Near East and the Asia-Pacific region. China, Ecuador, Indonesia and the Philippines also reported improved performances, which could be attributed to increased exports of cooked frozen loins to regional tuna canning industries.

The Americas

During the first nine months of 2024, imports of canned and other types of ready-to-eat tuna products increased marginally in the US market. In contrast, Canada reported a substantial rise in imports (27 698 tonnes; +28.57 percent year-on-year); the main exporters were Italy, the Philippines, Thailand and Viet Nam.

In Latin America, canned tuna imports increased in Argentina, Chile, Colombia, Mexico and Peru, in comparison with the same period in 2023.

Europe

During January–September 2024, imports of semi-processed and processed tuna into the European Union increased marginally (+1.56 percent year-onyear) at 518 331 tonnes. Imports of cooked loins, mainly into France, Italy, Portugal and Spain, totalled 148 495 tonnes, +7.24 percent compared to the same period in 2023. Canned tuna imports declined in Belgium and Germany but increased in Austria, Czech Republic, the Kingdom of the Netherlands, Poland, Romania and several other markets in eastern Europe.

Among the non-EU markets, canned tuna imports increased in Norway, Switzerland, the United Kingdom and Ukraine.

NENA (Near East and North Africa)

Demand for canned tuna remained stable in the NENA region throughout 2024, where Thailand has been the main supplier. The top five markets in this region (Egypt, Israel, Libya, Saudi Arabia and the United Arab Emirates) imported 130 610 tonnes of canned tuna from Thailand during JanuarySeptember 2024, up by 45.68 percent over the same period in 2023. Total imports of canned tuna in the NENA region were estimated to be 200 000 tonnes in the period under review.

Asia-Pacific

The market for canned and processed tuna in the Asia-Pacific region was steady in 2024. The leading importers were Australia, Japan, Republic of Korea, Malaysia, Thailand and New Zealand. Thailand mostly imported cooked loins (56 000 tonnes) for reprocessing, while the other markets imported endproducts from the regional tuna canners.

During January–September 2024, Japanese imports of canned tuna were 51 700 tonnes, down by 5.5 percent year-on-year as domestic production increased. Imports in the other regional markets increased moderately.

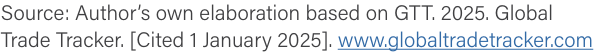

Prices

The export price of frozen skipjack (for canning) from the Western and Central Pacific Ocean remains firm at USD 1 550–1 600 per tonne in JanuaryFebruary 2025, as compared to USD 1 350–1 450 in January–February 2024.

In Europe, frozen whole skipjack and yellowfin prices have been stable, while prices of cooked, single-cleaned skipjack loins remain unchanged.

Outlook

As of end-January 2025, tuna catches in the Western and Central Pacific Ocean were poor for most vessels. Nonetheless, the export price of frozen skipjack to Thailand remained stable at USD 1 600/tonne during early February 2025. Furthermore, tuna canners in Thailand have ample stocks of raw material left over from 2024 imports comprising 843 388 tonnes of raw frozen tuna (+24.3 percent year-on-year) and 74 758 tonnes (+33 percent year-on-year) of cooked frozen loins. Based on this scenario, Thailand is not expected to run short of supplies for reprocessing during the first quarter of 2025. Prices of whole frozen tuna are unlikely to rise soon.

In Europe, tuna canners are currently taking stock of their inventories in preparation for the Easter demand during late April.

In Japan, overall business in the high-value sashimi trade has slowed down since mid-January but is expected to revive during the upcoming Spring festival in April–May.

[email protected]

www.seafood.media

|